How to Meal Plan for the Month

This might sound odd but I’ve found that meal planning for the entire month is far easier than trying to think about it on a week to week basis. Today I’m going to talk about the advantages I’ve found by planning on a monthly basis and how I do it. This is also going to cover a few other things related to food that I think are worth sharing and that make monthly meal planning easier.

To start, I plan the month about a week before the month actually starts. You’ll see why I do that when you jump below to “how we food shop”.

Let’s start by how we (generally) buy our food. This process has really been the silver lining of COVID; now that I’ve adopted this “new” way of feeding our family, I don’t think I’ll go back to the way I used to do things (which was kind of haphazard and resulted in a lot of wasted food and expensive take out).

Currently we food shop via a weekly grocery delivery. We get ours on Monday mornings between 5 am and 7 am. I love this time slot. Anything I need to start the week – even Monday morning breakfast – arrives then and it just feels like a great, organized start to the week. Plus it makes me notice those leftover bits of stuff in the fridge that didn’t get eaten and needs to get tossed.

The first delivery of the month has the perishables I need for the week plus the staples that I’ll need for the entire month (this is why I plan for the next month about a week out from the ending of the current month we’re in). This also means that I’ve spent a chunk of the monthly food budget upfront (see my budget blog post for more on that). However, I also now know that I’ll have most of what I need for any meal planned for the month already available!

This is the magic of monthly planning…by having the basics for any of my meals, it’s easier to flip-flop a couple meals here and there if we want to change the plan on the fly. This simple idea (re: flexibility) has been the key to the success of meal planning. Back when I was planning just a week at a time, I wouldn’t feel like cooking what I had planned for that day and then suddenly, I felt like I had nothing ready to make as an alternative. For example, say I lost track of time and am late to starting dinner that day. With a month of meals at a glance, I can now look around the coming meals and switch something in that’s quicker to make! Odds are I’ll have the supplies too! More flexibility means more success.

When I first started thinking about meal planning, doing it for a month felt crazy and too controlling. Now that I’m doing it, it actually feels more freeing. An added bonus is that I can just look at the meal plan and see what we’ve already eaten which has resulted in adding more variety to our meals. Plus, I’ve been more apt to try new recipes. It’s a total game changer.

Ok… back to how we actually get food.

Staples we buy at the start of the month include things like meat, extra loaves of bread, or other bakery items. I will freeze all of these that aren’t required for that week. Additionally, I buy ready made biscuits in that pop-can (yes, I know – they are totally unhealthy and packed with hydrogenated oils but they make a nice treat with dinner from time to time… any fantasies you might have about us eating all organic and natural, you can just throw out the window… we eat our fair share of processed crap). We buy some perishable items in the first shop of the month that hold well like onions, garlic, fresh ginger, sweet potatoes and a couple heads of cauliflower…

I also enjoying shopping at the winter farmers’ market hosted by Grow It Green Morristown. It’s on Sundays. It’s a little bit harder to plan what I’m going to buy there, but in general, I get carrots, beets, fresh bread, and some yummy baked treats. That’s where I will buy any pork based products like sausage or bacon. That’s not to say that I don’t like the chicken and beef I find there, but because I know I need those things in certain amounts and cuts, I seem to buy them more through the delivery service. I’m aiming to change that and by more locally produced proteins. I also buy a big 25 lb box of ground beef from Five Mary’s from time to time. It comes frozen and packaged in 1 lb sleeves of meat.

For items like rice or boxed rice mixes (I use those a lot), I buy in bulk through Costco from time to time. We also have a really good Latin grocery market in town and I stock up on dried beans, rice, lentils and the like there.

In short, I find that it’s much easier to grocery shop this way (another benefit of monthly meal planning). After the big, top of the month shop, and I buy pretty much the same things each week. Greens for salads, milk, deli stuff for the kids…

Next let’s talk about cost savings. The way we save money using this method is pretty straight forward.

1. We don’t eat nearly as much take-out because of the flexibility of the system. I feel less burned out on cooking and I’m actually enjoying cooking more. Which, to be honest, I do 99.9% of the cooking for our family. John makes this dish called beefaroni. When I can’t make dinner, I let him know it’s a beefaroni night.

2. I don’t buy things we don’t need. I’m in the kitchen when I place the grocery order so I can just check the supplies in real time. I’m also not temped to buy things because I’m hungry or it “looks good.”

3. If something we use often is on sale, I buy two (sometimes more!)

4. I can use “cheep” things like rice and beans more often and in more creative ways.

5. Less waste! We actually eat pretty much everything I buy and leftovers don’t become “forgotten.”

Next, the actual planning part.

If you’ve read my other posts, you know that I’m a paper person. I use iCal on the computer and I print off a monthly calendar using the “print” button, but I take off all the things I’ve entered into iCal so essentially, I’m printing a paper, blank monthly calendar spread. On to this I write what we’re having for dinner each night, M-F, for the month. I leave the weekends open because we’ll usually just graze on whatever leftovers are around, order take out, make a random pot of soup, or get something at the Farmer’s market. I post the calendar on the fridge door when I’m done filling it in.

First, I fill in Friday. I make homemade pizza once a week. Usually on Friday. It’s ridiculously easy to make. I use the basic King Arthur pizza flour blend. Then I fill in “burger night”. We have burger night usually twice a month. It’s hamburgers, tater-tots, frozen peas and a salad. Then I start at the 1st of the month and fill in.

I usually do a new recipe (or something that takes more effort) on a Monday because I’ve got more time on Monday evenings and I feel “fresh” for the week (vs burned out and ready to tell everyone to just eat (more) ramen). I like the Pioneer Woman’s Dinnertime cook book for easy, but crowd pleasing, things and I’ll jot down the page number too. If I find something on-line, I print out the recipe while planning the month so I have it for food shopping purposes. Tuesdays are usually either tacos or pasta of some kind. I try to also have a vegetarian meal once a week (curry is a favorite, served with frozen naan) and we like to have fish at least once a week too. Often it’s breaded and fried, but the kids eat it, so I’m happy with that. Alternatively, they love salmon patties and I always have the ingredients on hand (so that’s an easy one to do the previously mentioned “flip-flop” with if I need a simple thing to make). I’m a big fan of one-pot type meals so a crock-pot, insta-pot, or Dutch oven meal are all favs for me too. A note on the insta-pot… I just got one. I’m already a fan because of how fast you can cook dried beans (no soaking!) and the water left from the cooking is so perfect for soup. Did I mention we eat a lot of soup? With some crusty bread or a pile of grilled cheese sandwiches cut into quarters?

Now let’s talk about the order of meal line up. For the most part, I’m not that into meal “prepping” where you chop up a whole bunch of stuff on Day 1 and use it for meals on days 1-3 or whatever. I like to keep my systems as simple as possible. Having to think about making a whole chicken on Monday so I can have some scrap of it left on Thursday is like, way too much brain power for me. The most I aim for is try to make enough quantity of dinner so at least the adults can have leftovers for lunch the next day. That’s it. I’m not aiming for perfection here.

Lastly, let’s talk about side dishes. If the “main” is something like vegetable curry, then I pretty much serve it with rice or bread or both and call it good. If it’s more heavy on meat, I have a side of vegetables and either rice, bread, corn chips, potatoes... I have two skinny boys and a cyclist husband so they need carbs. Me? Well, let’s just say I should not be eating like they do…

For sides of veggies we pretty much have the same things often: roasted cauliflower, sweet potatoes, steamed broccoli, frozen corn, frozen peas… Add butter and salt to that and they will eat it. Or A1. Which is like liquid salt. I don’t care. As long as they eat vegetables. My kids love raw peppers (red or yellow only) and raw carrots, so I try to have those on the table before everything else. When they sit down, they just start eating those. John and I eat salad; even if it’s just taking a handful of arugla out of the box and throwing it on the plate we’re eating from, that counts as a salad. Simple, people. We also eat rice often. Usually some type of boxed mix (that has a lot of salt… I know) and then I dump in rinsed canned beans and chopped (really chopped!) spinach. The kids eat it just fine. Just don’t push it… there is an upper threshold for how much spinach or kale they can deal with before they reject it. Me too, to be honest.

We eat together and we go around the table and everyone picks someone to say something nice to. You can get up and leave when you are done, without having to wait for others to be finished eating. If you’re ready to leave, then I really don’t feel like asking you to stay. We all see enough of each other anyway… I find that the people who want to stick around and chat do so naturally and sometimes that’s all of us and sometimes… it’s just me and John which is like, a huge win.

And that my friends, is dinner at our house.

UPDATE: For the month of February, I’ll be posting what we actually ate for the week. Maybe these meal plans will help you for your #monthlymealplanning !

Always open to your tips, tricks and thoughts! Drop a comment below if you’ve got suggestions for others!

Seeds and Seed Starting Resources

It’s that time of year when gardeners everywhere are drooling over seed catalogs. Due to the pandemic, so many more people have started home gardens and that has led to seed shortages. Combine with social distancing rules and reduced staffing at the warehouses from which your seeds are hand packed, plus the shipping delays … well…tt’s a feeding frenzy out there! It makes me wonder what Tulip Mania of the 1600’s must have been like!

I will not lie, I’ve also been buying seeds that I don’t actually need… I just covet them. I have a seed hording problem. Good thing most seeds last a long time in the freezer. Dig to the bottom of our deep freezer and you’ll find a wildflower garden. Another “fun” thing about buying seeds during a pandemic is that going to a big open space (like a greenhouse) feels relatively “safe” so it’s the only in-person shopping I’ve done. In January, there is like, no body at the garden centers. They are still putting the Christmas stuff away… but they do have seeds! That’s an exciting, fun outing for me!

So let’s talk about seeds. This is going to be pretty much me rambling on, so here goes…

Where to buy seeds?

I’m going to assume that you don’t need mass volumes of things (like, a packet of 25 tomato seeds is plenty, right?). These are the seed companies that I recommend and why.

Johnny’s Seeds: They have just about everything you want, and they are a co-operative, meaning they are owned by their employees. They have a large supply of organically certified seeds and they do not carry GMO seed (if you’re new at this, F1 hybrids are NOT GMO – it’s just a cross between two plants…). I find that some of their seed is over priced in the smaller packets. Just sayin’

Select Seeds: I love Select for flower seeds. They have lots of interesting things plus their germination rate is solid. I find that particularly true for sweet peas. Sweet peas are all the rage right now (as they should be, since they are like divine inspiration you can bury your face in) but because of that, I’m finding low germination rates on some sources.

John Scheepers Kitchen Garden Seeds: Get the catalogue. It’s such a fun one. It cheers me up whenever it arrives. Solid germination rates here too. Really nice for vegetable seeds and as the name implies, all the flowers and herbs that a kitchen garden should have. I also like their seed packets – they have a lot of good information on them.

Floret: So buying seeds from Floret is definitely comparable to Tulip Mania. This year the hot ticket was a particular Zinnia type (Little Flower Girl), which I was lucky enough to get a packet of, and everyone is eagerly awaiting her release of Zinnia Golden Hour next year. This is what I’ve found with Floret seeds, they are reliable but not exactly the best germination on some things. The packet it pretty but the type is too small and I wish there was more growing information on them. Floret is great for hard to find things and I like to support them because they are family owned and breeding a lot of their own seed, which for a plant nerd like me, is super cool.

Rene’s Garden: I’ve gotten these at local garden centers and I find the price is very good, solid germination rates and they have some lovely home garden collections, like their patty pan squash packet where you get three kinds in one packet. I’m into stuff like that for the veggie garden because most people don’t need 25 of the same plants…

How to Store Seeds:

I have a sh$t ton of seeds. Like I said, I horde them, but they’re small, so who cares? It’s not like hording old newspapers or something, right? Anyway, they are kind of like trading cards for me. I like to flip through them and see what I’ve got, dream about what they’ll become, organize them, etc. I keep them in three ring binders and use these plastic photo page things from the 1980s when we actually used to print photos out. This way I can have everything alphabetized and (theoretically) not order what I’ve already got. I usually shop for seeds with a beer in hand, at the end of the day… it’s entertainment for me… so yes, I have a lot of duplicates because I adore them (not because I was drunk seed shopping… never).

I keep the binders in a cool, dark closet so the seeds stay fresh. I’ve also got seeds in the freezer. These are ones that I need to have pre-chilled anyway, so I just leave them in the freezer indefinitely. It’s like pulling out hamburger meat when you need it… I guess?

When do you start your seeds?

You wont like this answer: It Depends. It depends on your agricultural zone (i.e. when your first and last frost are) and what you’re planting. For instance, things like tomatoes and eggplants you start pretty early because they take a while to get to a decent size. Other things get too leggy if you start them too early. Somethings don’t really like to be transplanted, so you’ll direct seed them (think carrots… anything with a decent taproot). You can look up pretty much anything you’re growing on Johnny’s website and it has seed starting instructions. Some things need dark to germinate, somethings need light, etc.

But once you’ve got your seeds, you can use this handy dandy seed starting planner that I made and keep notes on what you did so that when it comes time next year to do this all over again, you don’t have to look everything up!

Lastly I want to close with talking about starting seeds in a “sunny window.” I never do this. To me that’s like giving a baby watered down milk. It’s only a fraction of the nutrients a baby needs to start off a heathy life. Plants are like human babies. You want to give them everything they need at a young, tender age so they thrive (vs just survive). I use cheep fluorescent lights that I hang on shelf and it works great. Doesn’t have to be a fancy grow light, but a widow doesn’t cut it.

I’m sure you have a zillion more questions. Feel free to drop them in the comments below.

Part III: Planning ad Goal Setting for 2021

As promised, I’m going to talk more about all things planning related during the month of January. Already I’ve posted two blog entries: one about my 2020 Vision Board and another on our monthly budgeting method. I believe in the importance of reflecting on the previous year before planning the future, hence why my review blog entry came first. To make progress on goals, you need to be honest with yourself about where you’re really at.

The financial planning post was actually easier to write because our goals for saving & spending are relatively stable from year to year. We are at a time in our lives when our priorities feel set for the next three or four years. Our next, up-coming large benchmark, financially, will be when our oldest son goes to college, which will be in about four years. Financial planning right now is more about keeping up with the process I’ve developed this past year that works for me.

This week I am to post about business planning and business goal setting for 2021. I anticipate this will be done over the course of a couple posts. I’ll cover farm planning in a separate post, as well as personal goal setting. This order feels most logical to me since the personal goals incorporate my business goals; it’s difficult to extract one from the other as an entrepreneur and a farmer.

Along the way, I’ll be sharing some of my favorite resources for being more intentional with my time and energy in the New Year. If you’re interested in working together on your planning for 2021, please sign up for our up-coming Vision Board workshop! If you’ve got ideas to share or questions, please drop them in the comments below!

How we set our family budget... #oldschool

It’s that time of year when people are setting goals. Odds are that loosing weight and saving money are probably the top two goals… at least those are my two top goals year after year. Today I wanted to share how we budget. Be warned: I am a paper person. This process is low-tech and old-school.

Over time I’ve learned to accept that I will never use an app to budget. Likewise, I believe the measure of a good system is one you actually use. While ours may seem overly simple, it works for us. In the past, I’ve tried to really, really tease things apart. It became too overwhelming and thus, I stopped budgeting.

Our process:

We budget monthly, by paycheck. We get paid on the first of the month.

Our paycheck is auto-deposited into our savings account. From there, we automatically transfer out the exact same amount each month into our checking account. The magic here is that we are automatically saving each month, at the start of the month. We save first.

Since we get paid at the start of the month, the same amount each month, we assign every dollar to a spending category, remembering – we’ve already hit our savings goal for the month first.

Additionally, we keep a separate checking account specifically to pay our taxes and insurance. We move money into that account quarterly from the savings account. This system has changed our life, in that I’m less worried at tax time about having the funds to pay our property tax bill each quarter and our end of year taxes.

Summary: We have three accounts. Savings. Spending. Spending just for Insurance/Taxes.

Let’s also talk about credit cards. We have an American Express, Visa (from TD, which I hate and need to close… goals for 2021), a Chase Amazon Visa (5% off our Amazon and Whole Foods purchases), and I confess I have a TJMaxx Rewards card ($10 coupons are a treat). Here’s the catch: We ALWAYS pay off our credit cards in full each month. Sales, rewards, all of that is meaningless if you pay late fees or interest on purchases. I use the AmEx at all times, unless I they don’t take it or if it’s for Amazon/ Wholefoods.

Now here’s how we actually budget:

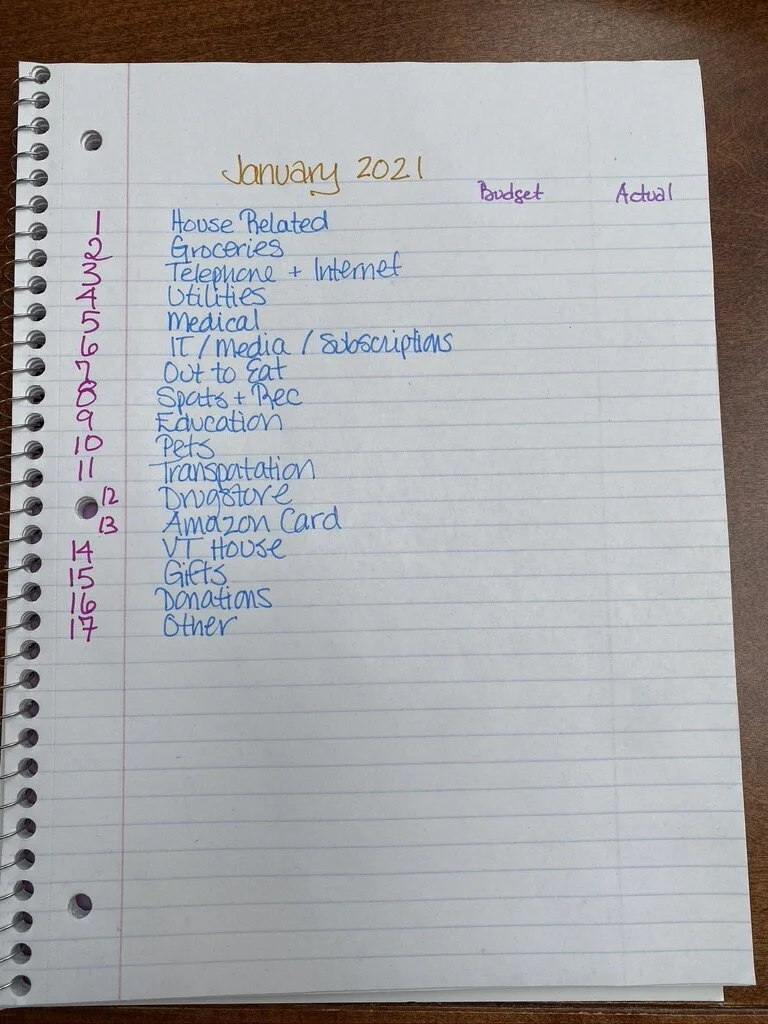

First, I buy a 97 cent, 1 subject, college ruled notebook. I only use 18 pages, but I buy one for each month. Total annual investment in budgeting: $12. I also really like the colored Papermate Flair pens in the medium point. I find that having the right paper and pens is also essential. I don’t know why, but it is. I don’t question this – I just comply with what my weird brain demands.

Next, on the opening page of the notebook I have a list of 17 categories that work for us. I assign them each a page number and the amount that I think we’re going to be spending that month. All 17 line items total our monthly paycheck. Every dollar is essentially pre-spent. This means, if I’m spending a lot in one place, we need to cut back some other place.

Let’s look at the categories and then we’ll look at January as an example.

1. House Related

If we go to home depot, this goes here. If I cut a check to the lawn mower guy, it goes here. If we have an electrician come, it goes here. You get the point.

2. Groceries

This also includes trips to the farmer’s market and beer. Beer is food these days.

3. Telephone and Internet

Our cell phones and internet services at the house.

4. Utilities

Water, gas, electric…

5. Medical

This is an on-going large expense for us. We have insurance but it doesn’t cover anything out of network…

6. IT/ Media/ Subscriptions

Netflix, Apple payments, New York Times, Wall Street Journal, etc.

7. Out to Eat

I love take out. Just saying.

8. Sports & Rec

We all ski/ snowboard. John bike rides a lot. Kids skateboard. If we buy a season pass to ski, it goes here… we have to plan ahead to know what month we’re going to buy it in.

9. Education

Things like instrument rentals, extra classes, summer camps.

10. Pets

We have a dog and a fish tank. The chickens are budgeted with the farm. Vet bills go here… if we buy dog food at the store, it goes here but if we buy it off Amazon I don’t bother to break it out of that bill (see category #13).

11. Transportation

Gas and car repairs. Our insurance is paid out of the Tax & Insurance account so it doesn’t get budgeted here.

12. Drugstore

Any Rx we buy or other “stuff” while we’re there…

13. Amazon Card

We have a Chase Amazon credit card for the 5% you get back on purchases. We also hate Amazon (for a zillion reasons) but we still do shop with them. I can’t deal with sorting out what purchases go to which category so I just have a blanket lump sum that I budget for this card. Again, we try not to shop from Amazon so that makes it easier. It’s harder to do this with Whole Foods. If I do buy from Whole Foods, then I save the receipt and I add that number to the tally for Groceries (Line #2) but I don’t deduct it from the Amazon line. Weird. I know. But my purpose here is to know what I spend on these categories that I deem important. Again, this system works for me.

14. Vermont House

We own a second home in Vermont. All the electric bills, snow plowing, propane, etc. are budgeted here. However, the property taxes, mortgage and insurance are paid from that separate account.

15. Gifts

If we buy gifts for people outside of the immediate family, that goes here. For example, last year we had a lot of Bar/ Bat Mitzvahs, so that gets budgeted for here.

16. Donations

We donate over 10% of our annual income. It’s important for us to spread this out so that it doesn’t all come at one time (like December when every non-profit is asking..). Some of this is tax deductible, some isn’t (i.e. political contributions).

17. Other

Now you’re like “What kind of a dumb category is OTHER?!” But the reality is that we don’t really “shop.” Haircuts, nails, clothes shopping, etc. we never really did a whole lot of that before and now it’s even less. All that gets thrown in here. So does anything on that TJMaxx card. If I think that I need a new dress for a party that month, I’ll budget for it. Odds are when I go to assign funds for that… I’ll find something already in my closet to wear.

How I assign the amounts I think I’ll spend:

I have been doing this for at least a year, so I have a basic record to follow. January is going to be a very big medical bill month for us because one of the kids has a medical procedure and I know we’ll end up having to spend our entire annual medical deductible. This means that things like eating out we need to dial back on (hence, really good meal planning this month and trying fun new recipes). Plus, there is a bit on the Amazon card that will be “above normal” due to holiday spending (remembering the Amazon card is it’s own line item and gets paid on the 21st of each month so anything bought at the tail end of one month, carries to the next). Also, our heating bills are very high. Normally we have the house pretty cold during the day because we aren’t here, but with all of us being home and living in this crazy house...well, let’s just say it’s a bit pricey. We wear a lot of layers and I’ve recently started wearing these amazing North Face Tights every day… I have a third pair coming.

Now you know about the categories, the accounts we have, the credit cards we have and how we plan each month, let’s talk about how we actually implement the budget:

About 1-2 times a week, I get a cup of coffee and while in my PJs (these are my favs) I get out the paper notebook, pens, my phone and my check book. I open the app for the Visa and AmEx and I literally go through each charge (since the last time I did this, a few days earlier) and write down the date, place and amount by category. For example: If I bought $20 of gas at Quickcheck on Dec. 15. I’d turn to page 11 (Transportation) and write “12/15 Quickcheck $20”

I do this with the Visa, AmEx and checking account.

Exceptions to this process are: If I buy from TJ Maxx on that credit card, I save the receipt and enter it in the “Other” category (pg. 17). For the Amazon card… I just allot an amount to the line item of “Amazon card” and it’s like I “ set it and forget it”… don’t try to buy off the card. I generally know about what we spend so I pad that number by about $150.

Again, it helps to get in a rhythm with regularly looking at your spending because you’ll develop a deeper understanding of your spending habits and then gain a “financial intuition” about what you’re actually doing… and then you can feel if you’re going off course.

At the end of the month, I tally up the number for the category on each page and transfer that total back to the original, first page of the note book. Then I can compare my budget amount to my actual amount. Pretty simple.

Why this system works for me:

Planning ahead – thus, seeing in advance - where your money is going makes you hold on to it tighter! If I think at the start of the month where I have to spend (i.e. health care) and where I’d like to spend (um, take out…), I consciously make compromises, vs spending blindly and then coming up short on what I need to pay and then have to dip into our savings.

This method also results in feeling less deprived (hello, take out!) but also results in being ok with what I’m not getting (bye-bye, home décor). It just depends what your priorities are.

Example: I’ve been saying for six years that I want to “decorate” our home, but honestly, each year I’d rather choose to spend on things like season ski passes or John and I regularly getting a sitter and going out to eat (now, just take out and with the kids).

Some other notes:

Going to the drugstore. We have to go every month, in person – it’s because of the type of medication. We don’t go until the order is ready for pick-up (i.e. no wondering around the store) and I always send John to get it. Why? I will find something to buy if I go into the drugstore. Period. Moral: Know your weakness and avoid it.

Grocery Shopping: I have always over spent on food. When I lived alone, I shopped like I was apart of a couple. Now that I’m a family of 4, I shop like we’re a family of 5. However, meal planning helps prevent over buying because I know what we actually need. My over buying is based on the fear that we will run out of something (and thus, starve… it’s all kind of irrational). Planning reduces that fear. Also ordering on-line is great to aviod just randomly picking up stuff because I want it… I’ll do a future blog post on meal planning.

How has COVID impacted our budget?

We’ve been super fortunate that we haven’t seen a reduction in wages from COVID. Changes we have seen are a lot less driving (transportation line has been way lower), but higher take out bills (I can’t cook all the time). I also think the price of food has risen. We also donated way more money in 2020 than I had planned to because of both the need (food pantries, etc.) and the election cycle. Instead of panic shopping, we panic donated to pretty much every dem running for office. Hopefully with the election done, we’ll be spending less on politics! Hair cuts have been less (John was every 3 weeks… his hair looks so good longer). TJMaxx is totally not happening right now… so that’s a savings. And I don’t need any new clothes. I bought new Carhart overalls in 2020 so I’m pretty much set for 2021 in the clothes department.

And that’s it folks. Have a question? Or a tip to share? What do you use? Drop it in the comments!

Reflecting Back on the World's Most Hated Year

Before I jump into 2021, I wanted to hit pause to reflect on the year we’re leaving behind. I know that most of us are cheering as we say goodbye to perhaps the most hated year, Worldwide.

One of the best tools I have for thinking about the year that is concluding is my Vision Board. I make one every January, as well as host vision board workshops. Here are some things that really stood out from all the images and words I collected:

1. The phrase “Uncommon Beauty.” Like most of what I glue on the board, I don’t really understand why I’m choosing it in the moment, yet over the course of time, these words and pictures reveal their meaning. Here at the end of 2020, understand this phrase so clearly. To be honest, I’ve never felt “beautiful” as defined by being attractive or pretty. That doesn’t mean that I grew up feeling ugly either. Perhaps I didn’t feel that I qualified as “attractive” because my mother was a model when she was younger and while we share genes, I don’t have the “All American”, blond, skinny with bright green eyes look that made her regular in magazines like Seventeen. Those photos of her defined to me what “beautiful” was. That stereotype of beauty was reinforced through my high school experience where the “pretty people” were blond and tan from summers spent at the Shore (Jersey folks will understand) and were invited to parties with kegs.

I’m now 44, far from the days of high school. Yet only recently have I resolved this issue with feeling attractive. What’s even more ironic is that this peace come has when I’ve gained like 10 lbs! (Hello, survival beer – I’m looking at you!) Right now I feel the most beautiful I’ve ever felt. Yes, I feel like I need to loose weight and “get in shape” but I look in the mirror and I actually feel like I look good. Perhaps it’s from being away from people for so long – all the parties where I couldn’t figure out what to wear or the day to day getting dressed and looking in the mirror to see if it looks “right” or my grey roots were too obvious or whatever – all the little times during the day that I would judge myself based on what I thought others might think. Being away from everyone gave me the space to re-evaluate my own thoughts about beauty. And that has been an uncommonly beautiful gift.

2. “Sleep Better Every Night” I firmly believe that sleep is the BEST way to keep healthy. That being said, I struggle with getting solid sleep. In my quest to take better care of myself, I got an Apple Watch. It’s been helpful to see my progress with reaching my 8 hour an night goal. To achieve this goal, I will probably need to be in bed for 9+ hours since it takes me awhile to actually get to sleep and I wake up often. Right now I’m getting about 7 hours. I still have this 2 am wake up period but it’s getting better.

3. “Cover Story” I was in Women’s Day Magazine this year so I feel like I can totally connect to this part of my vision!

4. “A Handmade Life” Over the last few years, I’ve stepped away from a lot of the crafty things I used to do. I deeply miss making things with my hands (that might sound weird, since I’m a flower farmer). At the start of 2020 I felt pulled to connect back with my crafts. Well, thanks to coronavirus, I had time to pick back up sewing, mending pants, canning, and all kinds of crafty hobbies that I hadn’t touched in years.

5. “After the Chrysalis” This season of being away from others has truly been a chrysalis experience. I feel different / changed. I feel something more wonderful/ powerful is emerging in myself. I’m excited about that prospect.

I’ll be making my 2021 Vision Board shortly.

Here’s to New Beginnings!